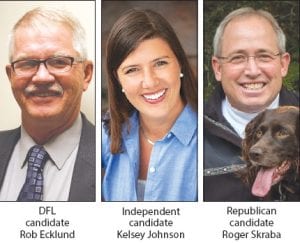

The three candidates running in the special election to fill the vacant Minnesota House 3A seat are on their final push, door-knocking and making phone calls. Rob Ecklund of International Falls, Kelsey Johnson of Babbitt and Roger Skraba of Ely each sat down with the Cook County News-Herald recently and answered a few questions. Following is the final in a three-part series of candidate questions.

Citing a “war on potholes,” last year the Senate proposed a 16 cents a gallon increase in gas taxes. Do you support this proposal?

. Ecklund: I’m not sure I support a pay-at-the-pump gas tax, just because it’s so polarizing. But I do support a wholesale fuel tax. It still goes to the consumer, but it’s applied more widely. We’re all driving more fuel-efficient vehicles, so we need to figure out another way to fix our roads. Our infrastructure is our lifeline. . Johnson: No—and now I’ve heard that the governor wants an 18 cent increase—that’s a 45 percent increase. Transportation is the highest cost a family in this district faces, as much as $1,000 a month. That is one reason I think the government is out of touch. That said, our transportation system does need funding. I would support some kind of constitutional amendment that dedicates the taxes on things like new tires, batteries and oil changes to transportation. . Skraba: No, it’s too much all at once. Does our infrastructure need work? Yes. Does the gas tax do it? No. If you drive a Prius, you’re not contributing as much.

We need to figure out where we can get $20 more from everyone. That’s about what we need. Maybe we could do it through a tax on car parts. If you’re a good citizen and take care of your car, you would get taxed less. It would be a kind of regressive tax.

What I’d love to do is take apart MnDOT [the Minnesota Department of Transportation] and put it back together again. That’s where you’ll find a lot of savings.

In the last legislative session, Representative Tim O’ Driscoll, from Sartell, Minnesota introduced a bill to allocate unclaimed lottery money to Minnesota schools. Would you support a bill like this?

. Ecklund: I’d have to look at the background for it, but on the face of it, it sounds good. People have paid for the tickets; it’s paid for. It could be a way to help our schools. They are all struggling, like Cook County Schools, with the referendum not passing. I’d have to look at the numbers and the statutes, but it sounds like a good way to use unclaimed lottery money. . Johnson: Oh, yes, especially because many school levy referendums didn’t pass, as happened in Cook County. Our schools are really struggling to stay open and stay viable. We need to do all we can to support our schools, to attract and keep good teachers to maintain our lifestyle. Healthy schools are one thing that attracts people to this area. . Skraba: Absolutely! We did something similar when I was in college at North Dakota State, I was finance commissioner, in charge of a budget of $830,000 a year for three years. Every year what wasn’t spent went to the general budget. I met with the NDSU comptroller and we were able to use that money to buy the debts down.

I think this is a great idea. You’re not affecting the general levy because the general fund doesn’t reflect the lottery money. It could be $1; it could be $1 million. I think we could all agree to that. We could all agree to support education, which ultimately benefits all of us.

Cities, counties and school districts are faced with a number of state and federal unfunded mandates. What would you do to alleviate this?

. Ecklund: The first thing I would like to do, through the budget surplus that it looks like we are going to have, is to create a solid, sustainable process for county aid so when counties are putting budgets in place, they have an idea of what they’ll be getting.

Local governments are planning their budgets from January to December and the state from July to June. Counties and cities go through budgeting for six months, hoping the money will be there. It’s not fair to local government. I’d like to see a permanent formula in place, so whatever it is that a county gets, they know what it is. If this happened, some counties could give some levy relief.

The federal government is just as bad. I serve on the Human Services Performance Council. Through that we’re able to tell the federal government that counties need more money, for things like out-of-home placement and so forth. I think there is some initiative there to get some more funding for counties.

We need to think twice about the pie-in-the-sky ideas. The state says, ‘We’ll fund you for two years,’ and the county hires someone—like the aquatic invasive species program. My real concern is that after two years, the funding is gone and it is really difficult for the county to let someone go. . Johnson: On the federal side, an example is the special education formula. That throws out our back as a state. I will continue to work with Senators Klobuchar and Franken and Representative Nolan to fully fund these mandated programs.

ACT testing is another non-mandated example. Schools are required to pay for ACT for all students. I don’t know if it’s a good measure of student performance or if it is necessary. I would do all I could to lift requirements like these.

Funding for child protective services such as support for foster families is a real problem.

Counties need to be funded for the work they do to protect our children.

County program aid hasn’t been fully funded and vetted. I’d like to see more property tax dollars stay here, to be used here instead of dedicated to the state. Yes, property taxes pay for roads, social services, etc., but who knows the needs better than local governments? . Skraba: Not pass anymore. Once this has affected you, you understand. It sounds good, but once you start vetting this in the community, you find you have to pay for all these things. You end up saying, “All we wanted was this, but we have to do this? Pay for this?”

You have to know the rationale for these unfunded mandates—if they are there for some arcane reasons, we need to get rid of them. If they are there for a reason, we need to abide by them.

Polls are open:

from 8 a.m. – 8 p.m. at the Cook County courthouse on December 8.

Mail ballots must reach the Cook County Auditor’s office by 8 p.m. that day.

Loading Comments