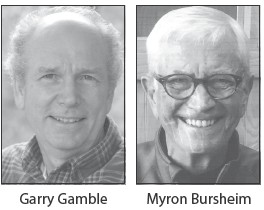

With the presidential election only a few short weeks away, it is time to remember that there are other candidates running for office. In Cook County, District Two Cook County Commissioner Garry Gamble is up for reelection, and Myron Bursheim is running against him. The Cook County News-Herald asked each candidate the same six questions. Here, below, are their answers to those questions. Be sure to exercise your right and go to the polls and vote.

Why are you running for county commissioner?

. Garry Gamble: After being privileged to serve four years in this capacity, I have often asked myself this question. Being a county commissioner is neither ‘comfortable’ or ‘convenient’; at least it shouldn’t be, if you are really serving the people who entrusted you with the responsibility.

So, “Why am I running for a second term?”

Objectives

»»Protect personal freedoms and property rights.

»»Prioritize real needs balanced with our community’s ability to support identified, and agreed to, priorities.

»»Consistently advocate for principled policies to direct the governance of the county.

»»Remembering there’s a big difference between elected officials who believe they’ve been ‘empowered to spend other peoples’ money, and those who understand and respect that elected officials are, in fact, ‘entrusted with other peoples’ money.

»»Serve with integrity: be principled, honorable, accountable and humble.

Future Considerations

»»Making Cook County an affordable place to live.

»»Nurturing economic opportunity.

»»Maintaining local jurisdiction— keeping state and federal government from usurping local control.

»»Finding reasonable balance between protecting our environment and personal freedoms to enable economic opportunity.

»»Exploring ways to create truly affordable workforce housing in our county.

»»Keeping Cook County ‘home’ for those who have lived here since childhood.

. Myron Bursheim: This is my home, and I care about our county and our future. Involvement as a volunteer in our community and encouragement from others inspired me to consider becoming a candidate. I decided to offer an alternative to an incumbent who would have been unopposed in this election. I offer professional administrative experience and expertise in budgeting and finance. I believe in action, not talk, to get things done that need to be done.

What do you feel is the most pressing concern for Cook County?

. Gamble: Certainly declining revenues is a major concern; however, I would argue, declining social capital supersedes revenues as the most important issue facing Cook County. It is foundational to every other issue we face as a community. Social capital addresses the issues of: Trust—people trusting their leaders as well as their neighbors with different social backgrounds and ideology. Engagement— people actively engaged with their leaders and with each other; people taking part, being involved; doing something for another without any immediate expectation of return. When we as a community develop our social capital we become less vulnerable to crisis and can more easily tackle problems . . . like declining revenues that affect governments, school board decisions, the Economic Development Authority (EDA), hospitals or other enterprises and, ultimately, you and me and our families. .

Bursheim: The most important concern that needs to be addressed is housing and its role in economic development. The EDA has shown great improvement in its effectiveness by having knowledgeable volunteers and hiring competent staff. Investing in our EDA’s efforts will have great potential to increase our tax base, which will more than pay for itself in the future. The EDA has a great start in its two initiatives regarding worker and moderate income housing by collaborating with Grand Marais and Lutsen. We should learn from these projects and use the experience to continue good work. The plans to provide for assisted living facilities to help our older citizens is very important. This will also open up other housing options for others in our entire County. If elected, I would advocate for the EDA to study how we can diversify our economy in the future. Housing development is also needed for this to happen.

The budget grows every year but the population isn’t growing. Is there a way to keep the levy at 2-4 percent? Or will it continue to grow at an 8-20 percent increase?

. Bursheim: If elected, I think it would be a good process to focus financial planning around the 4-6 percent level. The 6 percent plan would only be looked at because of some contingencies that the professional staff would forecast based on some future issues that need to be budgeted for. I would only support the 6 percent focus if it would likely mitigate the 19.9 percent increase that hit us this year just to maintain current services. Part of this discussion should also involve our tax capacity, and how it compares to other comparable county governments. If costs keep increasing regarding staff and benefits, this may require the county to seriously look at creating efficiencies in service to reduce expenses. . Gamble: It has been suggested if we just “bite the bullet” this year, and accept the 19.9 percent proposed levy increase, things will level out to a levy average of approximately 4.3 percent annually. This statement is predicated on the assumption that “things will remain the same” and, historically, this has not been our reality.

In the area of Public Health & Human Services, alone, we have experienced significant fluctuations in costs that are ‘out of our control.’

Out of Home Placement costs have more than doubled since 2014; from $216 M in 2014 to a projected $509M in the 2017 budget. State reimbursement revenues, on the other hand, are projected to be 31 percent less than those received in 2016. This amounts to approximately $62M, which accounts for a total net impact on the 2017 Levy of 6.4 percent or 2.6 percent in one year.

The fact is we have witnessed a $36 million reduction in the state’s contribution to Out-of-Home Placement Costs, imposed by legislators in the last nine years.

Nearly 70 percent of Cook County’s Out-of-Home Placement costs would have been reimbursed by the state under proposed legislation–which we actively supported–that was not acted on during the 2016 legislation session. This would have amounted to a $356 Msavings, or a 5 percent reduction in our present levy.

In Minnesota, counties are responsible for a much larger share of child protection funding than in most other states. On average, states report that in 2000 they obtained 49 percent of funding for child welfare from federal sources, 40 percent from state funds, and only 11 percent from counties. In 18 states, the counties paid none of the costs. By contrast, in Minnesota that year, of the approximately $500 million spent for child welfare costs, 38 percent came from federal sources, 22 percent from state funds, and 39 percent ($195 million) from counties (mainly from local property taxes). In only two states did counties pay a higher share than we do in Minnesota.

Minnesota’s reliance on counties for such a high share of funding is cause for concern for several reasons. Unlike higher levels of government, counties have only one main funding source (property taxes) and the least flexibility during recessions in how funds may be raised or spending adjusted.

In the area of Employee Benefits, we are looking at a 19.1 percent increase over last year’s health insurance coverage for employees. This amounts to a $300,000 hike, which comprises 4.5 percent of this year’s levy. Total cost of the plan is $1,869,276.

If you add these two budget line items, alone–Out of Home Placement Costs and Employee Health Insurance–we are looking at a levy increase of 7.1 percent.

So, “No. There is no way to keep the levy at 2-4 percent,” unless the community and commissioners are willing to tackle the uncomfortable task of cutting services. It is unrealistic to depict county budgets as ‘predictable. »»Nearly seven in 10 Americans have less than $1,000 in savings –GoBanking Rates,

September 2016 Survey. »»Americans over 62, including retirees on a fixed budget, said they were limiting their spending primarily because of stagnant income. –Bankrate’s Chief Financial Analyst

Greg McBride, October 2016. »»Paul Bedard, Washington Examiner, reported, in April of this year, that collectively, Americans will spend more on taxes in 2016 than they will on food, clothing, and housing combined.

Elected officials should not ignore these realities when setting budgets.

What are the advantages of the county going to an administrative form of government?

. Gamble: County governments are under great pressure to deliver high quality services in a fiscally constrained environment. The County Board of Commissioners believed establishing an administrative form of governance in 2013 was a way to dramatically improve the day-to-day operations of Cook County government, and by doing so, to secure the efficiencies and cost savings that would benefit the residents and taxpayers of the county.

A county administrator is responsible for the overall administration of the county, including: »»Implementing board decisions, policies, ordinances and resolutions in the most efficient, effective, and fair manner possible »»Making recommendations to the county board on policy development and the provision of county services »»Preparing and managing the county board agenda for board meetings »»Preparing and submitting a proposed annual budget and long-range capital expenditure program to the county board

In my April 17, 2013 letter to the Board of Commissioners regarding the possible transition to an administrative form of governance, I stated the following:

“I envision the position of County Administrator as someone who could work with Department Heads to develop staffing levels and organizational structures that meet the needs of the Departments while at the same time comporting with the fiscal ability of the County.

One of the many attributes I believe any candidate should bring to the position is the ability to frame decisions under conditions of competition for scarce resources.

Foremost, however, is the trait of stewardship; stewardship being defined as: “The conducting, supervising, or managing something; especially: the careful and responsible management of something entrusted to one’s care.”

Stewardship is a quality that defines the highest levels of government service. If we can find a County Administrator who understands their obligation to carefully and responsibly perform their functions as stewards of public funds, we have found the best.”

. Bursheim: The county administrator is a trained professional who supervises the day-by-day operations of all the county departments and non-elected staff. This builds accountability by establishing oversight of hiring, firing, disciplining and suspension of all county employees. The most significant fiscal responsibility is the preparation, monitoring, and execution of the county budget package with options and recommendations for its consideration and possible approval. The advantage of this responsibility is to provide consistent and professional budget information, which will hopefully preclude micromanagement of data by any commissioner to interpret fiscal information for political purposes. The hiring of an administrator will result in significant savings by assuming responsibility for the bidding and superintendence of construction projects. This has been an apparent problem for the county prior to a functioning administrator.

The county owns a lot of property/ buildings that are in need of repair. What can be done in a timely fashion to fix or replace them?

. Bursheim: The county must first of all do a Facility Condition Assessment (FCA), which is conducted by trained professionals to perform an analysis of the condition of a facility or group of facilities that may vary in terms of age, design, construction methods, and materials. After this is done, a plan needs to be developed based upon the greatest need and cost issues pertaining to the most cost effective funding options available. This process is necessary to make sound decisions based upon industry standards, not opinions.

Bonding is a good source of funding for projects that we will need long after the bond payoff, especially when we have an excellent bond rating and a favorable interest market. It costs much more later when you delay projects and planning in this regard needs to be proactive, rather than reactive. It is also important to remember the importance of avoiding “being penny-wise and pound foolish.” . Gamble: We need to begin by recognizing the importance of including ‘replacement’ costs in our budgets. The private sector addresses the ‘cost of depreciation’ both because of the reality as well as the added tax advantages extended to for-profit entities to encourage economic development.

Given county governments and other qualifying not-for-profit organizations are tax-exempt, the need to track these replacement costs is, too often, ignored or not viewed as immediate. This is a false reality that has led many government entities to where they are today; facing significant capital maintenance or replacement costs.

If we are of the opinion that annual double digit levy numbers are oppressive, imagine if the board funded major ‘replacement’ costs by means of the levy!

The most fiscally responsible way to address aging facilities is to either: 1.) Include an annual contribution to depreciation (replacement) as a line item in the budget; or 2.) Use our favorable bond rating to bond (borrow funds)–at “earned” low-interest rates. Use these monies to address identified, prioritized, real needs; the debt on these funds being retired through available revenues, which may or may not be derived from levy dollars.

Some counties don’t give any money to nonprofit groups. Should the county continue to fund the various nonprofits as it has done in the past, or should it discontinue the practice?

. Gamble: As many in the community are aware, commissioners, in addition to county board meetings, sit on a number of other boards that focus on specific issues related to county governance. During discussions, with other—primarily Arrowhead county commissioners— I have asked this very question. The response I get is, “No. We had to end the practice of funding local nonprofits a long time ago due to lack of funds. It was simply a matter of priorities.”

Should county revenues decline or county expenses increase–such as non-funded mandates– the community of Cook County will be compelled to have this conversation will need to draw on its ‘social capital’ in addressing its priorities.

The first of these public discourses took place in April of 2015 at a town hall meeting. The question was asked, “What criteria would you like to see the County Board of Commissioners apply when evaluating allocation of tax-payer dollars to local organizations?” (Criteria understood to mean standards, rules or principles for evaluating or testing something.) As a result of this discussion, an equitable approach to granting discretionary funding requests was implemented, during the 2016 Budget process, to assist commissioners in making determinations as to the allocation of taxpayer dollars. The discretionary funding application incorporated the suggestions fielded during the non-mandated program funding town hall meeting.

Future considerations, it should be clearly understood, will be determined by actions taken by elected officials who, hopefully, will have a basis for their decisions that will reflect the will of their constituents in the context of well-identified priorities and available funds.

. Bursheim: Personally, I agree with the funding for discretionary/nonprofits. They do many great things in our county. However, as a commissioner and if future costs keep going up in proportion to revenues, I would recommend that this area be looked at to determine their importance in government spending and make decisions accordingly.

Loading Comments