Commissioners voted 3-2 to set the Cook County 2017 levy at $8,477,865, an increase of 19.9 percent at their Tuesday, September 27 meeting. The county levy must be set by September 30. The preliminary levy figure can be reduced, but not increased later.

Commissioner Jan Sivertson, who served on the budget committee, said, “This is a year of researching and normalizing. I support this 19.9. Not that we won’t find ways to reduce it even further, but if we don’t approve the 19.9 it will tie our hands…”

Sivertson said she liked the way the budget process was handled this year, noting, “I think this is the first time the county is looking at a sustainable budget model…We’re really making some effort at what goes into a budget…I feel like it’s a new world for us. In the future we can look at small increases, based on cost of living. We’re looking at big picture right now.”

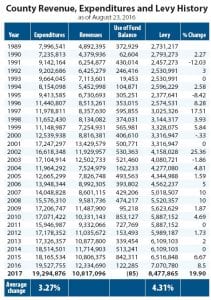

Of the increase, Sivertson said, “It seems painful right now.” However, she pointed to the history of county revenue, expenditures and levy produced by County Administrator Jeff Cadwell (see chart on page A3. Sivertson noted that over time the budgeted costs increased an average of 3 percent. So, to keep pace, she said, the levy should increase an average of 4 percent per year.

Todd Smith, who has been working in the Cook County Assessor’s Office since March 2015 takes the oath of office to become the new Cook County assessor on September 27. Court Administrator Kim Shepard administers the oath as Smith’s wife, Pat looks on.

Commissioner Frank Moe said, “I think tying the hands of this board would actually be a good thing. We all represent people whose hands are tied by their budgets.” He gave examples of narratives from his constituents living within their means. He noted that on his road, residents elected not to put down gravel this year because the property owners couldn’t afford it. He said another family in his district has a broken down car so they are struggling with schedules to share a vehicle. And a businessman in his district has a work truck that has been out of service all summer because he can’t afford to repair it or buy another.

“We’re asking these people to increase the sales tax—which will hit all of our budgets. And then we’re going to also ask them to increase their levy by 20 percent, which will be for most people hundreds of dollars. I don’t think it’s responsible,” said Moe.

He asked that the county administrator come back with cuts, acknowledging that could mean going through the budget “line by line.”

Commissioner Garry Gamble said he was also disappointed that the levy increase had only been reduced from 26 percent to 19.9. “I would concur with Commissioner Moe in that it is our job to make difficult decisions.”

Commissioner Ginny Storlie moved to set the levy at $8,477,865 with the 19.9 percent increase. Her motion was seconded by County Board Chair Heidi Doo-Kirk.

During discussion of the motion, Moe lobbied for an amendment to the motion to cap the levy increase to 9 percent. He said the median home value in Cook County is slightly less than $250,000, so the 19.9 percent increase will equal a $200 increase in property taxes for most homeowners.

His suggestion for amendment and the motion to increase the 2017 levy by 19.9 percent carried, with Storlie, Sivertson and Doo-Kirk voting in favor. Moe and Gamble voted no.

After the meeting, Board Chair Doo-Kirk, Administrator Cadwell and Auditor Braidy Powers confirmed Commissioner Moe’s comment that with the 19.9 percent levy increase taxpayers would see an increase of approximately $206.

Cadwell said the current taxation on a property valued at $250,000 is approximately $1,037, so the total taxes to be assessed if the levy increase passes at 19.9 percent would be $1,243.

Powers said the county tax total might be slightly less because all homestead taxpayers in the county receive Taconite Tax Relief Credit. That credit of $289 is distributed between what property owners owe the county, city, hospital and school board.

Asked about Commissioner Sivertson’s comments about creating a sustainable budget, Doo-Kirk also pointed to the chart above. She stressed that county expenditures have not been increasing to keep pace with declining revenue. Doo-Kirk noted that every time the county board holds the line on levy increases—setting a levy increase of 2 percent or lower—a significant jump in the levy collected is eventually needed. “If you don’t increase the levy appropriately every year, you are just kicking the can down the road,” said Doo-Kirk.

Sales tax to benefit roads passed

One of the proposals to reduce the property tax levy is to use some of the funds obtained from a proposed sales tax for roads to offset the highway department budget. The enactment of the ½ percent transportation tax was less contentious, in part because this had been heavily debated at previous meetings.

Highway Engineer David Betts was on hand to talk about the proposal and answer questions on the draft list of projects to be funded by the transportation tax, starting with County Roads 45 and 17, the Pike Lake Road and the Mineral Center Road.

Commissioner Sivertson repeated what she said at a previous meeting, that she was opposed to not earmarking some of the transportation tax funds for repair or replacement of county highway department buildings. “I was opposed to taking facilities out,” she said. “I don’t know how you can take care of roads if you don’t take care of the equipment that takes care of the roads.”

Before a motion was passed, Commissioner Moe stressed that was the case, that the proposal does not include facilities. “It is roads exclusively,” said Moe, stressing that it can only be changed by resolution of the county board.

Moe added that if a change were proposed there would first have to be a public hearing.

Moe noted that the public spoke clearly in favor of repairs to Pike Lake Road and County Road 17. He said seeing County Road 17 on the draft project list was key to his support for implementation of the tax.

A motion was made by Gamble, seconded by Doo-Kirk to authorize and implement a ½ percent countywide sales tax for transportation as allowed by Minnesota statutes. The motion passed unanimously and commissioners directed Auditor Powers to complete the necessary actions to begin collecting the sales tax on January 1, 2017.

Job sharing in Public Health and Human Services

Public Health and Human Services (PHHS) Director Joshua Beck and Alison McIntyre brought forward the names of new staff members in their department. The board reaffirmed the hiring of Katie Smith as an office support specialist for 21 hours per week. That position was approved in April 2016.

The board also approved Elis Walch as an office support specialist for 22.5 hours per week. Commissioner Sivertson asked why PHHS was hiring two part-time employees instead of one full-time employee. McIntyre said PHHS was “backfilling” a job for another staffer who wanted to decrease her hours. She said it is a job sharing arrangement.

Agne Smith was hired as an eligibility specialist at 40 hours per week to fill a vacancy.

In other business

. Commissioners approved a special 1-4 day temporary liquor license for the Schroeder Area Historical Society for a wine tasting event at the Cross River Heritage Center.

. Todd Smith of Grand Marais took the oath of office to serve as the new Cook County assessor. The board thanked him for his work to date as assistant assessor. Commissioner Gamble added, “Thanks for going back to school on our behalf.”

Smith grinned and said, “There will be more of that!”

. The county approved a lease agreement for space on a billboard at Superior Ridge Resort to promote control of aquatic invasive species (AIS). Grant funding from the state of Minnesota for the county’s AIS program will be used to pay the lease of $4,500.

. Commissioner Moe said he had scheduled a listening session at 6 p.m. at the Hovland Town Hall on October 20 for the purpose of discussion of the county levy.

. Commissioners set a date for the 2016 Truthin Taxation hearing for 6 p.m. on December 1 in the commissioners’ room in the courthouse. At that meeting, citizens can review budget information and ask questions about where and how tax dollars are being allocated.

Loading Comments